16+ Calculate my dti

You divide 2375 by 10500 which sets out to be 0226. By dividing 84000 by twelve we see that your gross monthly income is 7000.

Analyzing Historical Default Rates Of Lending Club Notes R Bloggers

Your monthly gross income is 10500.

. Mortgage or rent Alimony or child support Car. Then to calculate the DTI ratio take the business total monthly debt payments and divide it by the business gross monthly income pre-taxes. Divide your monthly debt obligations by your monthly income to get your DTI ratio.

Calculate Your Mortgage Payments With Our Free Mortgage Calculator Now. Calculate Your Mortgage Payments With Our Free Mortgage Calculator Now. This will give a decimal that simply.

1200 400 400 2000 If your gross income for the month is 6000 your debt-to-income ratio would be 33 2000. The DTI ratio is calculated by converting the number into a. To calculate your debt-to-income ratio add up all of your monthly debts rent or mortgage payments student loans personal loans auto loans credit card payments child support.

Add up monthly debt payments The first step to calculating the debt-to-income ratio is summing. Now all we have to do is sum the debt payments and divide by gross monthly income to calculate DTI. Your monthly debt expenses for the back-end ratio are 2375.

Ad Use Our Online Mortgage Calculators to Estimate Your Payments Today. Lets see how that might look for someone who makes 4000 a month in gross income. The lower the DTI the better your odds are for being approved for new credit.

The total is your back end DTI ratio. Subtract your monthly debts from your monthly gross income your take-home pay before taxes and other monthly deductions. Your monthly debt payments would be as follows.

Car payment 400. DTI total monthly debt payments gross monthly income x 100 Step 1. Thats all there is to it.

Multiply the result by 100 to get your DTI percentage. Ad Use Our Online Mortgage Calculators to Estimate Your Payments Today. How to Calculate Your Debt-to-Income Ratio First youll need to know the amount of your monthly debt payments and add them up.

Total monthly debt payments divided by total monthly gross income before taxes and other deductions. If your yearly income is 60000 and your total monthly debt payments. Multiply the total from step 2 by 100.

VA guidelines on debt-to-income ratio requirements mandate a maximum debt-to-income ratio of 31 front-end and 43 back-end for borrowers with under 580 FICO and down to 500 credit. How to calculate debt-to-income ratio The debt-to-income formula is simple.

Tuesday Tip How To Calculate Your Debt To Income Ratio

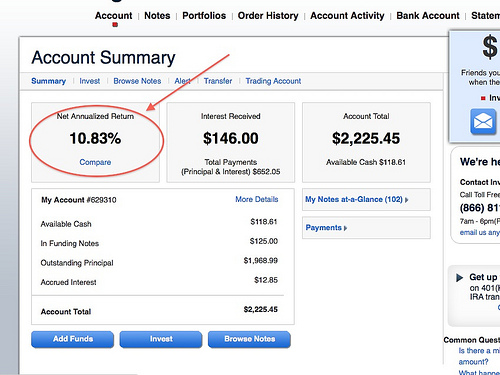

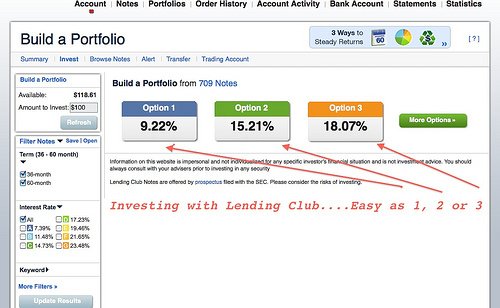

Lending Club Reviews For Investors And Borrowers Is It Right For You

Abstracts 2022 Haemophilia Wiley Online Library

Credit Card Amortization Excel Spreadsheet Kayacard Co Sheet For Credit Card Interest Ca Debt To Income Ratio Spreadsheet Template Excel Spreadsheets Templates

Incredible 2 Months From 2nd Of December Conventional Loan Mortgage Loans Mortgage Refinance Calculator

Pin On Free Printables

Lending Club Reviews For Investors And Borrowers Is It Right For You

Fha Loan Calculator Fha Mortgage Rates Limits Qualification Information Fha Loans Refinancing Mortgage Mortgage Loans

Debt To Income Ratio Can You Really Afford That Car Or Home Money Life Wax Debt To Income Ratio Student Loans Student Loan Help

How Much House Can I Afford Insider Tips And Home Affordability Calculator Mortgage Calculator Mortgage Mortgage Payment

Debt To Income Cheat Sheet In 2022 Debt To Income Ratio First Home Buyer Income

Analyzing Historical Default Rates Of Lending Club Notes R Bloggers

Renting Vs Buying A Home 55 Pros And Cons

Back End Debt To Income Ratio Debt To Income Ratio Debt Ratio Debt

Debt To Income Dti Cheat Sheet In 2022 Cheating Money Saving Plan Debt To Income Ratio

Debt To Income Ratio Calculator Debt To Income Ratio Income Debt

Renting Vs Buying A Home 55 Pros And Cons